Among the top insurance industry issues that PWC put on top of their profound insurance domain analysis are:

- Digitizing small commercial

- Improving customer experience with data analysis

- Driving change with InsurTech

- Getting value from the digital journey

Best CRMs for Insurance Agents in 2022

1. Nimble.com CRM

2. Zoho CRM

3. Pipedrive

When half of the issues raised in this comprehensive 42-page review are about the digital transformation of the industry, it speaks about the topicality of the technological software solutions in the sphere.

A massive 2.9% of the USA national GDP [$630 billion] is contributed by insurance carriers. With almost 6 thousand companies operating on the market [2.5K in P/C, 841 in life/annuity and 931 in health insurance].

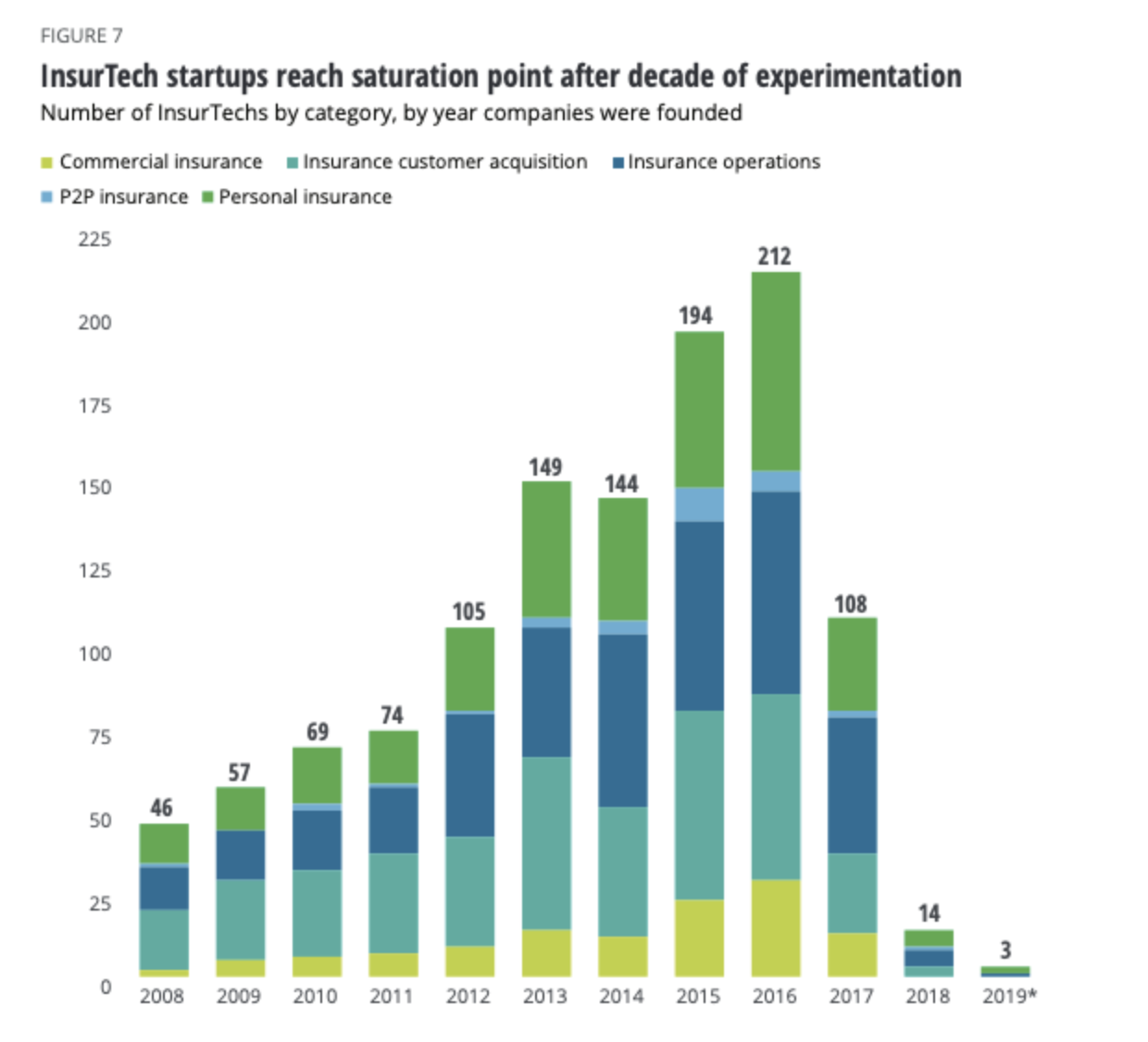

Now, that digital transformation is sweeping through the industry, early adoption of the risk management software became crucial for industry leaders to remain competitive. After a decade of experimentation, InsurTech has fallen with peak 212 companies founded in 2016 compared to 14 in 2018.

We have studied the offer on the market of insurance software solutions so that industry players can make an informed decision. Read more on how to use a CRM for insurance agents and a review of industry-specific client management software.

Categorization Of Insurance Industry-specific Software By Type:

With the boom of InsurTech, there emerged several solutions for almost every process or role in the insurance realm. There is a technology that deals with claim processing and then there is software, that helps to automate policy underwriting, commission management, insurance rating, etc.

Let’s review major insurance software categories available on the market now:

- Insurance rating software

- Insurance agency software

- Insurance policy software

- Claims processing software

- Commercial insurance software

Naturally, there is SaaS technology that is universal by design yet is widely used in the industry, for example, insurance CRM software, like Nimble CRM, which we will review later.

Insurance Rating Software: Features & Examples

This software is designed to optimize processes related to rate management and policy underwriting.

Main features include:

- Comparative insurance rating

- Broker / Agent Portal

- Carrier Upload

- Commercial Lines

- Multi-State features

- Multiple Line rating

- There exist insurance rating software solutions for casualty, health and life insurance

Examples of Insurance Rating Software:

Insurance Agency Software: Features & Examples

Insurance Agency Software is a fusion of Client Relationship Management software and a marketing automation tool with insurance-specific capabilities.

Main features for crm for insurance brokers include:

- Claims management

- Commission management

- Insurance rating

- Quote management

- Insurance policy management

Examples of Insurance Agency Software

Insurance Policy Software: Features & Examples

Insurance Policy software provides an overview for users of the policies at every stage from generation to renewal.

Main features include:

- Policy Generation/Issuance/Processing

- Cancellation Tracking

- Rating engine

- Reinstatement Tracking

- Reinsurance administration

- Underwriting management

- Quotes/Estimates module

Examples of Insurance Policy software:

Claims Processing Software: Features & Examples

Claims processing software is designed to optimize claims management.

Main features include:

- Claim resolution tracking

- Case management

- Adjustor management

- Payor management

- Policy administration

- Co-Pay & deductible tracking

- Electronic claims

Examples of Claims Processing Software:

Commercial Insurance Software: Features & Examples

Commercial Insurance Software is engineered to systematize the processes pertaining to the realm of commercial insurance policies.

Main CRM features for insurance brokers and agencies include:

- Policy management

- Claims Management

- Commission management

- Insurance rating

- Quote management

- Risk assessment

- Underwiring management

- Billing & Invoicing

Examples of Commercial Insurance Software:

Now that we have reviewed major features & examples of the best insurance software, it is time to review how a universal CRM for insurance agencies fits into this tight tech stack.

Why CRM Matters For Insurance Agents

The industry struggling to fully embrace the power of digital transformation is still in the experimenting stage. InsurTech has only subsided a few years ago with a $4.15 billion investment in 2018 alone. PWC estimates that technology modernization is still the #1 risk for the global insurance industry.

With all of the industry’s challenges, can universal CRM systems that are applicable across the board be successfully used and bring added efficiencies?

Absolutely.

Why? Reasons are innumerable, so below are just a few major ones:

- Universal [the practices implemented in this CRM technology are used already across many other industries. This translates into an expansion of horizons for a business, to put it simply. A narrowly-specified business gets a chance of exposure to global practices, and a chance to find new methods of saving time and streamlining processes].

- Customizable [due to the fact, that systems are designed initially to fit any business model, they suggest an amazing array of customizable features. For example, in Nimble CRM users can customize pretty much any data point. Every one of the functions offers a specific array of notions with a customizable field to it. You can create a customizable field in contacts, segments, pipelines, deals. Any data point can be traced and turned into sophisticated reporting due to this feature.]

- Reasonably priced [tech can get expensive. SaaS solutions that have a wide spectrum of applications, like customer relationship management systems, are sold to hundreds of thousands of users world over. This allows developers, like Nimble CRM, to keep rates flat and low: at just $19 per user per month, this CRM is easy to afford and budget for.]

- Powerful marketing automation [Marketing is at the core of client acquisition. It is commonplace knowledge that insurance agents need to see people. The more meetings the more money. Even if your sales skills are not that strong and your offer is not best on the market, 10-15 meetings a week will convert enough leads to provide for a family. Marketing automation features embedded in Nimble CRM allow for a constant influx of leads.]

- Email marketing [business correspondence may get tedious and become a feared chore overall. Email marketing and email communication with Nimble is fun. Your inbox allows you to access a person’s social media feed – so that you have a topic starter right there. You can send group emails. You can schedule email and check open rates].

- Contact management [Turn your customer data into a powerful communication and analytical mission control center. Segmentation and tagging features allow users to assign as many tags to any contact as needed. Based on those tags, users can send mass mail or create customized reporting.]

- Social Media [Nimble CRM was designed with a clear understanding of the game-changing role of social media. We made sure to integrate social media communication into the contact management module for best customer service and enhanced client loyalty.]

How To Use Nimble CRM For Insurance Agents

Upload Customer Data In A Few Clicks

Customer data can be uploaded to Nimble CRM in several ways, for example: with a spreadsheet or a third-party integration service like Zapier.

Due to its intuitive interface, this CRM for life insurance agents builds itself for users, once the contacts are in.

Segment You Database

Insurance companies have to deal with so many parties daily: clients, underwriters, claim adjusters, insurance actuary, insurance brokers, partners, vendors, colleagues, referrers.

The segmentation feature combined with the possibility to create a custom field or attach a tag to any data point, enables users to create granular levels of business activities.

For example, if you have all referees assigned with a specific tag, you can further mass email them or create a report based on this group only.

Social Network-Wired CRM

Nimble acknowledged the up-and-coming magnitude of the social media on billions of users at the early stage and invested a lot of effort and engineering at symphonizing the 2 worlds: social media and the CRM.

From the comfort of their CRM users can comment, share, mention on social media of their contacts. This feature makes communication so much more relevant and pertinent at all stages of the marketing funnel.

Get In-depth Analytics Working For Your Big Goal

There is no improvement to be made where there are no KPIs in place. Visual graphics and a powerful analytical module of the Nimble CRM allows users to create a report based on any criteria chosen from the mass of data fields.

Compare the deeps, lows, and peaks for best insights.

Plan Like Your Middle Name is Punctuality

Meetings are the bread and butter of an insurance agent. Managing a minimum of 2 personal meetings a day is quite an undertaking.

But 10 meetings a day is a recommended minimum that can sustain a business for an individual insurance agent.

A sophisticated yet intuitive calendar allows for easy bookings, a great dashboard-type overview of your schedule, and a reminder system.

Ensure Repeat Business with “Stay InTouch” Function

The “Stay In Touch” feature of Nimble CRM allows users to program a reminder to schedule with a chosen contact on a weekly, monthly, quarterly basis.

One of the most genuine ways to nurture a strong relationship with your client is to keep in touch outside of the business policy issuance & renewal cycle. Everybody calls when it’s time to renew an insurance policy. But if you find the time and discipline to keep in touch once every 3 months – the loyalty is so much more likely.

Allow Nimble to remind you of this simple but highly effective routine.

Integrate With Your Tech Stack

Nimble is part of the Zapier collection of applications, so users can easily integrate this app for smooth seamless data flow with over 2000+ business popular applications.

Alternatively, CRM can get data from a datasheet or other third-party services that ensure data integration.

Task Automation & Assignment

Effective task management is at the core of teamwork. In a business organism as complex as an insurance company, tasks must be distributed as per deadlines, duties, and religious discipline.

Nimble CRM allows you to create, assign, schedule tasks in a few clicks. The dashboard screen provides a helicopter view of all the processes for a company’s management.

How To Pick The Right CRM/Insurance Sales Software

There are some factors an insurance agent, broker, underwriter, adjuster, actuaries need to take into account while making a choice in terms of what’s the best CRM for insurance agents.

Industry-specific vs Universal CRM For Insurance Agents

Depending on the size of your company and your specificity [life insurance, property insurance, casualty, etc.], you may want to consider some of the specialized insurance agency software.

If you are looking for a technology capable of small insurance agency management, then you might as well stick with universal CRM as your primary tool over the price and all-encompassing marketing functionality.

Mid-sized and bigger companies, specifically those dealing in commercial insurance will need to consider an array of insurance software systems to ease the processes pertinent to the niche specifically: like commission management and policy management.

Bigger companies usually have a universal CRM additionally to complement industry-specific software for vendor management, client management, lead generation, and marketing automation.

Price

The insurance industry is a multi-billion business, but it’s tough for smaller companies to manage positive balance. This is why a flat fixed price of $19 per month per user for Nimble CRM is so popular with small and medium businesses. It’s affordable and an easy cost to forecast.

A 2-week free trial without a credit card allows users to fully test the product with zero risks.

Scalability

Consider if the software you purchase is good for bigger-sized operations?

When you purchase any type of insurance agent CRM software, you get addicted and somewhat dependent on the system. It is vital that it can service transactions of any quantities with the same efficiency.

Why Choose Nimble CRM?

Insurance CRM systems may get overly complex or pricey at times.

Nimble CRM is user-friendly yet extensive contact management, task management, pipeline management, marketing automation tool.

Used by 140 thousand professionals across all industries, it consistently ranks in the top 5 Customer Relationship Management systems by independent Capterra ranking.

But we know you, the insurance tribe, like to estimate your risks yourself. Please enjoy our 2 weeks of free access to all the features of this savvy time-saving tool without ever taking out your credit card. Just insert your email to start saving money, time, and getting more leads.