Every business owner needs to pay attention to a number of different things important for the business. The customer lifetime value is a necessary point on the list. If you’ve never heard of it, we’ll tell you everything you need to calculate your potential profit from your loyal customers.

What Is the Customer Lifetime Value?

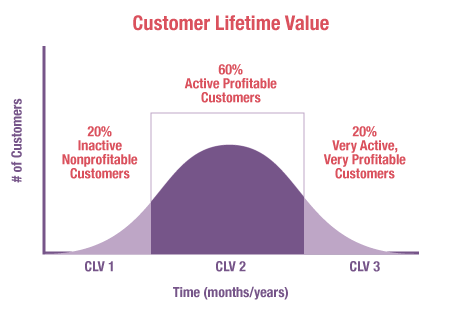

When it comes to marketing, the customer lifetime value (CLV), or as it’s also called, lifetime customer value (LCV) or lifetime value (LTV), is a possible income that will come from certain customers. In other words, you can count how much money you can get from one customer of yours in a lifetime.

It will show how much profit you can expect and this may lead to some changes and improvements. Furthermore, we will cover the formula for customer lifetime value and explain how to use it properly.

The Importance of Lifetime Value

It is important to check on your loyal customers. Make sure you have a list of them all. You might want to give them the VIP status so they will feel more wanted and special. It is easier to sell something to a person who already knows your product than to win someone’s loyalty first.

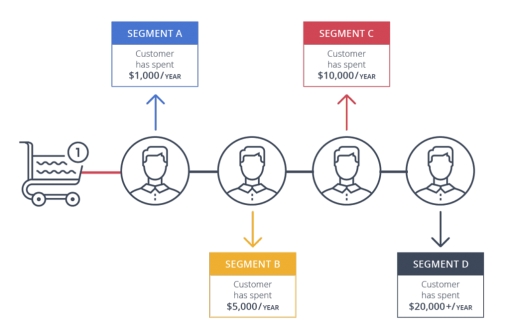

When you use the customer lifetime value calculation you understand your target audience better. It helps provide personalized shopping experience and in the long run, it will bring you more money and loyalty.

You can also offer some kind of a gift or a special discount for your VIP customers. In this way, you can make sure that they stay loyal. And with the right targeting, you can get new customers with a background similar to your VIPs. Offer the best service to your buyers, and they will never forget it.

Necessary Indicators You Need for Calculation

Lifetime value of a customer calculation is not just about statistics. If you don’t know a thing about your customer journey it’s a high time to find out how to calculate the lifetime value of a customer. Ask yourself some questions: how, when, where, how much, and how often do customers get your products? Alongside with answering these questions, measuring customer lifetime value will bring you more income stability and new ideas for business growth.

Also, if you are not sure about your strategy or it doesn’t bring you the desired results you should probably start with calculating customer lifetime value. You’ll know how much you should spend on advertising, what you need to change, etc. There are plenty of specialists who work on the strategies, and many metric services for calculation.

How to Calculate Customer Lifetime Value

When calculating customer lifetime value, you have to take many things into consideration. Find out what specific questions you want to be answered first. The most general way to start off is to see how much profit you get from a customer and subtract the amount of money you’ve spent on serving.

There are two main methods of calculating customer lifetime value:

Historic CLV

This is simply the growth profit sum from all purchases that one customer has made.

CLV (Historic) = (Transaction1+Transaction2+Transaction3…+TransactionN) X AGM

Where AGM is an average gross margin. You have to calculate it by yourself using the following formula:

Gross Margin = (Revenue – Cost of Goods Sold) / Revenue

You can find a customer lifetime value example on the internet very easily. But let’s try to apply the formula now.

Let’s say our AGM is as follows:

Gross Margin = (15,000 – 900) / 15,000 = 0.94%

Let’s say that the customer made 2 purchases and we need to see the profit without any expenses. So Transaction1 is 10$, and Transaction2 is 15$. You just have to add all the transactions that one customer has made. And our AGM is 0,94%. So here’s what we’ll have.

CLV (Historic) = (10 + 15) X 0.94% = $23.5

Predictive CLV

This one can predict the sum that one individual customer will spend during his lifetime. It is based on his customer portrait, customer behavior, and other similar factors. If you use the formula right, each prediction will be more accurate than the previous one.

CLV (Predictive) = ((T X AOV) AGM)ALT

Where:

- T is the average monthly transactions;

- AOV is an average order value;

- ALT is an average customer lifespan (in months);

AGM is an average gross margin.

Here is an example. Let’s say that the T is $2,000, AOV is $50, ALT is 816 months. And we have the AGM from the previous formula.

This is how it will look:

CLV (Predictive) = ((2,000 X 50) 0.94)816 = $7,614,000

This is the sum that an individual can spend on your goods during his lifespan which is 68 years (this is the number we’ve used in our example).

After getting these numbers you can create a better targeting, messaging, and nurturing for the customer. You can improve the behavioral triggers, and improve the customer support. With these results, your business will take a step towards a better future and bigger income. It is never too late to start improving your favorite things.

Case Study

People who use Amazon Kindle spend about $1,233 per year on Amazon. People who don’t use Amazon Kindle end up spending about $790 per year. This shows that Amazon puts a lot of effort into working with customer lifetime value. Amazon Prime was developed for VIP customers. It allows people to engage more, to make people want to be a VIP client, and to expand their lifetime purchase number.

Conclusion

Now you know what to expect from your business, what tools you might want to apply, and what next steps you need to take. The lifetime value of a customer formula is a powerful tool for those who want to achieve more with their business. Don’t hesitate to try it, and you’ll get the results you always wanted.