The success of a business working in the e-commerce sector depends on the quantity and quality of clients it attracts. The client base does not appear by itself: it requires investment. So, how do you determine the effectiveness of investment in marketing? Is there a tool that shows the real value of the client in the long term?

What is LTV?

The lifetime value of a customer (LTV) is the method used to determine the income expected from the client for the supposed lifetime (LT) from the first purchase until the moment when the client stops interacting with the company. Using this forecasting method, we get precise figures for the investments needed to attract and retain the client.

How Can LTV Benefit a Business?

Nobody wants to work without profit and at a loss. LTV indicates the current state of the marketing strategy, which is meant to help the company’s income to exceed its investment. Information about the lifetime and value of the client is the foundation for making informed tactical and strategic decisions:

- You need to have a clear idea of the potential customers’ attitudes towards the product at the stage of its development. This information will be necessary to determine the economic feasibility of a particular product change.

- The lifetime value of a customer formula will help avoid an ineffective strategy, develop, disable, or optimize marketing channels.

- According to the Harvard Business Review, supporting an existing customer base costs 5–25 times less than attracting a new buyer. Therefore, knowledge of LTV will help businesses increase profits, focusing on existing loyal customers at the cost of less investment and affordable marketing solutions. For example, if you have determined a low LTV indicator, then it makes sense to invest in holding up the customer base, instead of attracting new customers.

- Customer lifetime value definition is used for personalization – the division of the customer base into several segments with different levels of LTV. As a result, you will have the opportunity to develop a separate marketing strategy for each segment.

Analysis of behavioral factors will help to set up communication in accordance with LTV based on the understanding of customers’ motivation to buy.

How to Calculate Customer Lifetime Value

Marketers have developed a more or less complex and accurate customer lifetime value equation.

The easiest way to determine LTV is to count the difference between the customer’s lifetime income and expenses. For example, if the client paid $1000 for goods or services for the whole period, and this service cost you $500, then the LTV value will be $1000 – $500 = $500. In this case, with marketing costs of more than $500, the investment income would become negative.

A more advanced customer lifetime value formula looks like this: LTV= LT х ARPU.

Here ARPU is the average revenue per user. This formula is used by telecommunications companies. For example, a monthly subscription to service costs $50 and is usually bought for six months. So, LTV = 50×6 = $300. This calculation is made using average indicators, therefore the result may have some errors.

Calculating customer lifetime value with more accuracy will need additional source data:

- AOV – Average Order Value;

- LT;

- RPR – Repeat Purchase Rates,

And LTV = AOV х LT х RPR

Let’s calculate the customer lifetime value, for example, for an online store of accessories for household appliances. If regular customers buy on average twice a year and the average check is $50, and you hope that the client will keep using your shop for another 3 years, then their LTV = 50x2x3 = $300.

Obviously, such a customer lifetime value model has a prognostic character, since you can’t be sure the customer will continue to order in your store for three years. So you should take into account that customers’ buying behavior may change. If the customer base is almost stable at service companies, trade enterprises should use more complex methods to determine LTV, taking into account segmentation into active and random customers.

Historical Cohort Study

The essence of the historical method is to determine the average revenue per user (ARPU). If 20 customers brought the company $1240 over 3 months, then ARPU = 1240/20 = $62. Therefore, each client will bring the company 62 x 4 = $248 a year.

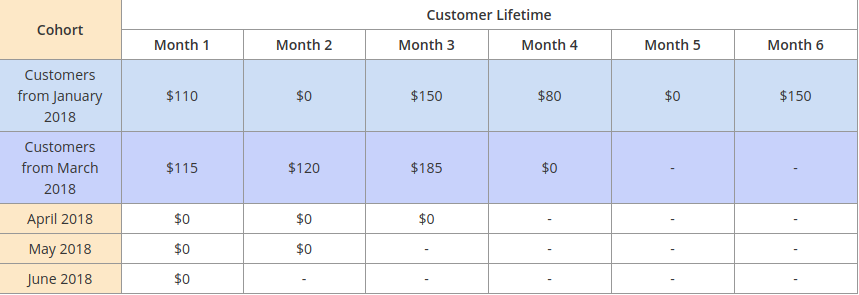

The subject of cohort analysis is a group of buyers who have common behavioral characteristics. The calculation is made by the above formula, but it determines the average income from a group of buyers.

Such data can show the dynamics of purchases, provide material to determine the number of steady customers, forecast when purchases can end, help to increase LTV, and evaluate the effectiveness of marketing activities.

Neither of these methods can be used for long-term forecasting.

Predictive Calculation of LTV

The goal of this approach is to model the behavior of the buyer and predict the subsequent actions. The formula uses such LTV metrics as:

- The average number of transactions;

- Average value or average income from an order;

- Actual profit from each transaction;

- Customer lifetime;

- The total number of company customers.

The first three parameters are based on statistics. The last two are not constant values and, therefore, the prognostic calculation of LTV can be misleading.

Traditional LTV calculation

Customer value is calculated by the following formula:

Where:

- GML – the company’s average profit from the client;

- R – the percentage of customers who made repeat purchases over a certain period

- D – discount rate.

For example, if the average profit from one client is $243, and 90% of buyers continue to shop at a 10% discount, then

LTV = 243 × (0.9 / (1 + 0.1–0.9)) = 243 × (0.9 / 0.2) = 243 × 4.5 = $1093.5.

How to Increase Customer Lifetime Value

Knowing about LTV gives you the opportunity to increase company profits. Here are some working methods for increasing LTV:

- Create a loyalty program that encourages repeat purchases. Profit from regular customers is always higher than from random clients. At the same time, keeping a loyal customer is much cheaper than attracting a new buyer.

- Work with the most valued customers. According to a Bain & Company study, an increase in investment for maintaining clients by only 5% can provide an increase in profit by 25-95%.

- Don’t forget about cross-selling and pre-selling. These marketing techniques provide more profit and do not require investments.

- Improve customer relationship management. Providing good service for your clients is still the best way to earn their loyalty. A good CRM such as Nimble will help you streamline the workflow and improve the way you interact with customers.

Conclusion

The importance of customer lifetime value is obvious. If you understand how to use this marketing tool, you will ensure the successful development of your company. Start working on increasing your LTV today, and see your profit rise tomorrow.