Banks have always been known as the most stable and reliable institutions throughout the history of the financial services sector development. But there was always another feature of the banking sector: conservatism, which partially helped them to stay a monopolist in the monetary market until recently.

Best CRMs for Financial Advisors

1. Nimble.com CRM

2. Zoho CRM

3. Pipedrive

Everything changed in the financial world with the arrival of CRM software for the financial services industry. The dominance of the banking sector in many financial products and services is far from obvious today, and the competition is increasingly going beyond the banking segment in a number of areas. There are not many options in this situation: either to remain a classic bank for a select and limited target audience or to keep up with the times, act proactively, be flexible and offer what any potential consumer of financial services wants.

What happens if financial services go without CRM software for investment advisors?

- Each manager works as they used to. Some record interactions with customers on paper, others use spreadsheets, some rely on their memory.

- Incoming calls are not fixed, it is impossible to determine whether all leads are properly processed, or to determine how an employee works with existing contacts.

CRM for financial planners will help:

- create a contacts database for all employees to use;

- control the work of each manager;

- analyze the work based on statistical data;

- develop a financial business strategy.

What Is a CRM System for Financial Advisors?

Theoretically, any way to control and record interactions with customers can be considered a CRM system, even if the contact history is written on paper. But talking about serious business, a CRM system for financial services is a special software developed in accordance with the tasks and scale of the company.

Why Do Financial Advisors Need CRM?

Best financial advisor CRM software provides an enabling environment for business development:

- Access regardless of geography. The level of services of the investment and finance departments is supported by the ability to access business data, as well as clients’ data, in real-time and from anywhere, regardless of the location of the system user.

- Representation of customers to a consistent standard. Using CRM solutions allows uniting all the employees of the sales department into one system, even if they are actually separated by time zones and distance. Thanks to this, sales managers, customer relations specialists, as well as leading managers of investment groups, receive an interface that ensures convenient work with clients.

- Providing general customer information. CRM allows receiving both qualitative and quantitative customer information, which helps the management to objectively and quickly determine the most promising customers (including target customers) regardless of geography.

- The organization of reporting between branches and other structural divisions makes it possible to carry out a marketing activities analysis, as well as to adjust the work strategy for various clients.

- Providing IT security. CRM has an effective system security model, providing access to special information to authorized users in accordance with the settings for access rights. Access to various blocks of business information can be divided according to user roles, which allows adapting the model to specific requirements.

How to Use a CRM: Best 10 Practices

Today, any potential client can find out information about any company operating in the financial market by reading reviews and comparing prices. Therefore, a business should be focused on customer retention based on data analysis and monitoring the work of personnel. Financial planning CRM is designed to provide quality customer service. Here are 10 useful tips on how to use the capabilities of CRM:

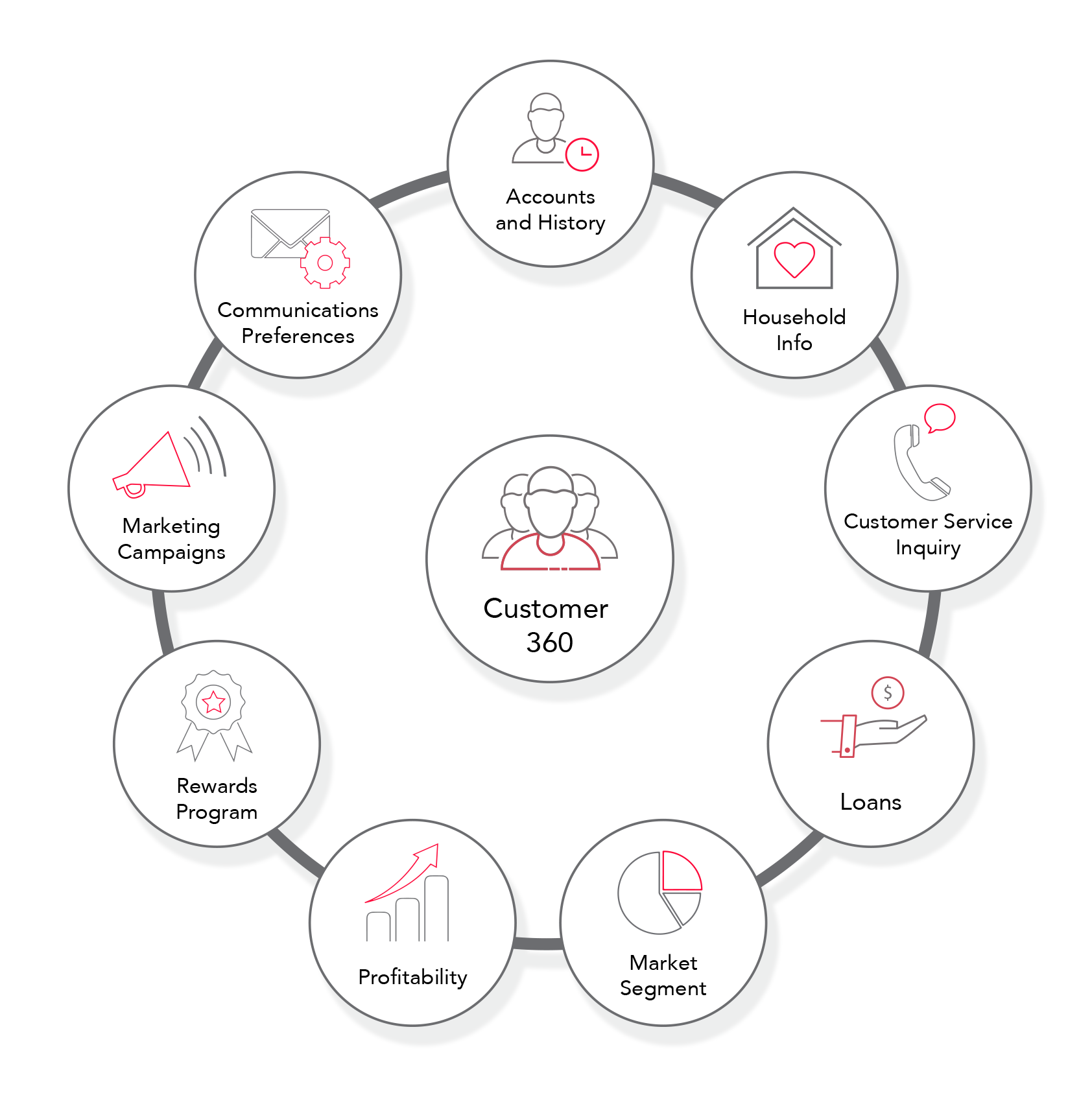

- Gather as much information as you can about the customer. The consultant has access not only to information about the client’s requests for services, accounts, and marketing segmentation but also to an effective way to communicate with them. This information appears before the employee’s eyes instantly and contributes to quick service, constructive dialogue and informed decision-making.

- Most clients are active in social networks, where they often share their impressions of the services of a particular company. CRM is available to all employees of a financial company working with clients, and it allows you to identify customer sentiment, and quickly respond to positive and negative reviews. Quick identification and timely response to every message that appears on social networks contribute to customer retention.

- Offer the customers self-service options. Provide access to useful information, the ability to quickly interact with chatbots or support. Use a self-service portal allowing customers to receive information using self-help resources and perform simple banking operations.

- Promote rewards. In a client-oriented financial company, a CRM consultant can control the balance of client rewards. To do this, you should add a reminder of remuneration to the interaction scenario, which always helps to improve the relationship between the client and the bank.

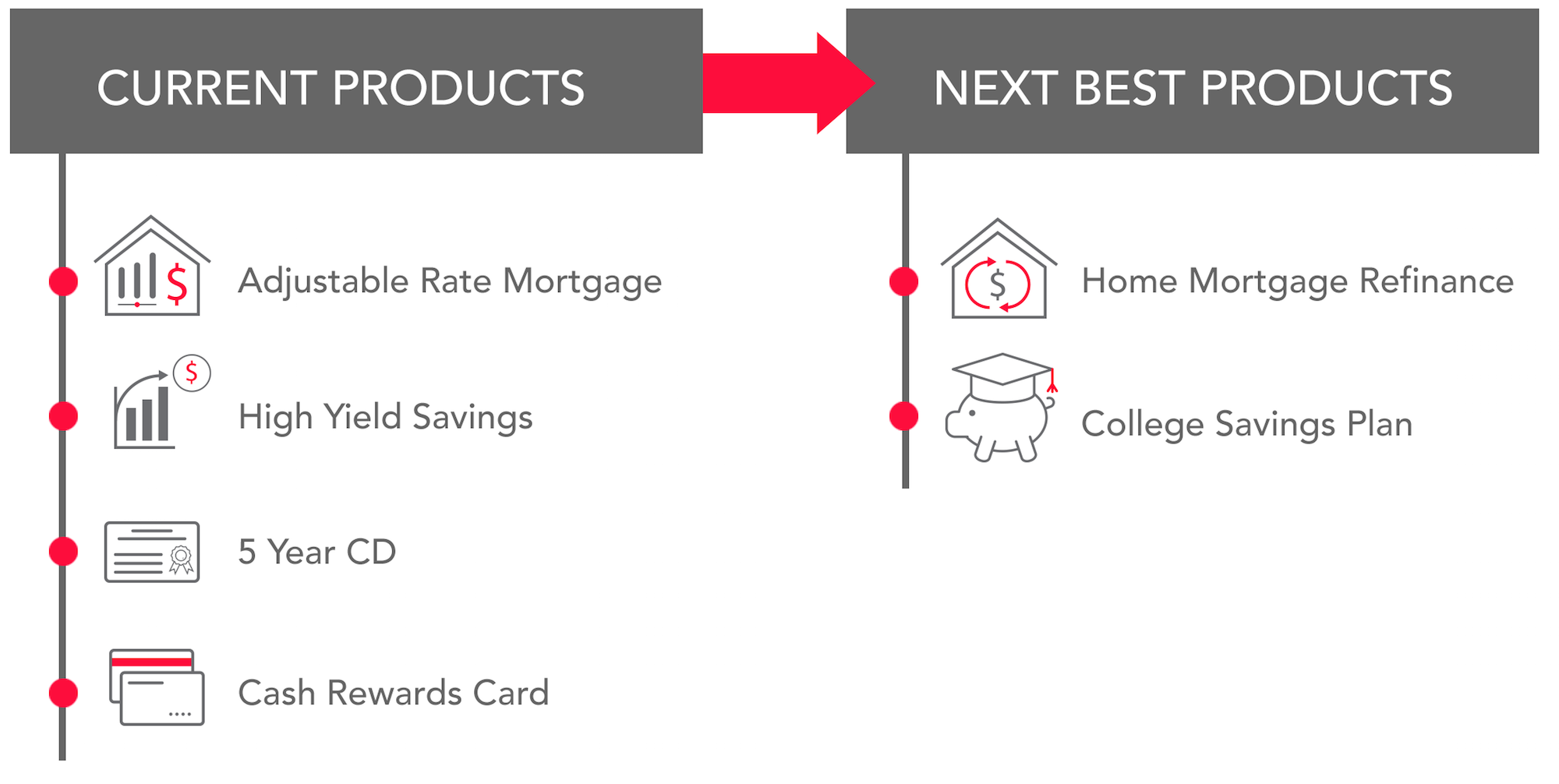

- Identify the next best product. Use the powerful capabilities of CRM to offer the most relevant product to your client. The system will help to make the most attractive offer based on all available information about the client, including their life circumstances and demographics. Each financial company can develop a formula for generating a system of the best fitting products based on the current range of services. This practice helps build trust between clients and the financial company.

- Besides identifying relevant needs, CRM can offer free products. This provides the consultant with more opportunities to improve the quality of interaction and create a positive image of the financial company.

- Execute tailored marketing campaigns. CRM is an effective tool for informing customers about promotions, new banking products. The system segments the customer base, due to which the distribution of messages occurs within the target audience, contributing to the satisfaction of financial needs.

- Use predictive analytics. Based on the CRM database, you can identify trends in the behavior of each client. The system can warn the consultant about a client who is about to leave for competitors. This makes it possible to take appropriate retention measures.

- The interaction of employees. CRM functionality ensures collaboration between employees of different departments. This allows you to quickly solve all issues, even those that arise suddenly. For example, a support staff member is not competent to change the wrong balance. The CRM redirects the call to the relevant person with an attached statement and comments, and the problem is solved quickly.

- Listen to each client. Surveys among the target audience help to identify customer attitudes towards the banking services and fix the errors.

Nimble CRM for Financial Advisers

The most popular top CRM for financial advisors will provide bank employees with contact information of all real and potential customers. To quickly create a customer database, we suggest using landing pages or ad traffic.

Minimal contact information is enough for the first interaction: phone number and client’s name. Nimble automatically supplements contacts with information from open sources, such as social networks and private databases. The CRM also offers intelligent social segmentation with quick filters, which allows creating and sending messages to segmented groups of clients.

Conclusion

Nimble is the best CRM for financial advisors. This powerful system provides a full set of tools to help a financial institution quickly build a customer base and collect as much information about each client as possible. Try Nimble for free and make sure your financial company gets new perspectives due to using CRM.